Some Americans may not get stimulus checks until August

The cash payments Congress authorized could take months to get delivered for some.

The federal government expects to begin making payments to millions of Americans under the new stimulus law in mid-April, but some people without direct deposit information may not get checks until mid-August or later, according to a memo obtained by The Associated Press.

The document from the House Ways and Means Committee says the IRS will make about 60 million payments to Americans through direct deposit in mid-April, likely the week of April 13. The IRS has direct deposit information for these individuals from their 2018 or 2019 tax returns.

Then, starting the week of May 4, the IRS will begin issuing paper checks to individuals, says the memo obtained by AP on Thursday. The paper checks will be issued at a rate of about 5 million per week, which means it could take up to 20 weeks to get all the checks out. That timeline would delay some checks until the week of Aug. 17.

Treasury Secretary Steven Mnuchin said Thursday that while he initially pledged to get payments started within three weeks of the law’s adoption, “I’m now committing to two weeks. We’re delivering on our commitments.”

The IRS, which he oversees, will ensure that “within two weeks the first money will be in people’s accounts,” Mnuchin said during a White House briefing.

“This money does people no good if it shows up in four months,” he added.

The memo from the committee’s Democratic majority says the timeline it made public Thursday was based on “extensive conversations with the IRS and the Department of Treasury.” The timeline is subject to change, given ongoing discussions between Congress and the Trump administration.

“The Committee remains focused on ensuring all eligible Americans receive their payment as quickly as possible,” the memo says.

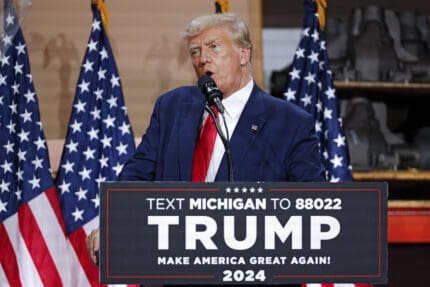

The payments are part of the $2.2 trillion rescue package signed into law March 27 by Donald Trump aimed at combating the economic ravages of the coronavirus outbreak.

Most people don’t need to do anything to get the money.

Reversing an earlier position, the government said this week that Social Security recipients who are not required to file a tax return will not need to file a very simplified tax return to receive their government stimulus check. The Treasury Department said Wednesday that the IRS will use the information on the Form SSA-1099 and Form RRB-1099 to generate the $1,200 checks to Social Security recipients who did not file tax returns in 2018 or 2019.

The checks will be issued in reverse order of adjusted gross income, meaning that people with the lowest income will get payments first.

The committee estimates that there are 150 million to 170 million U.S. taxpayers, which leaves 90 million to 110 million taxpayers who are either filers or nonfilers but about whom the IRS wants information.

The filers will need to receive a paper check unless their direct deposit information can be updated in the IRS portal. Nonfilers may need to file the simple tax return and likely include direct deposit information if they want to receive their rebates quickly. The IRS is encouraging taxpayers to file their 2019 returns as soon as possible.

The IRS expects to create a portal in late April or early May that will allow taxpayers to find out the status of their rebate payment and update direct deposit information, the memo says.

Anyone earning up to $75,000 in adjusted gross income and who has a Social Security number will receive a $1,200 payment. That means married couples filing joint returns will receive the full payment — $2,400 — if their adjusted gross income, which is what they report on their taxes, is under $150,000.

The payment steadily declines for those who make more. Those earning more than $99,000, or $198,000 for joint filers, are not eligible. The thresholds are slightly different for those who file as a head of household.

Parents will also receive $500 for each qualifying child.

The IRS did not respond to a request for comment Thursday.

Recommended

Ohio doctors fear effects of emergency abortion care case set to go before U.S. Supreme Court

A federal law that allows emergency departments to treat patients without regard to their ability to pay will be under U.S. Supreme Court scrutiny this week, and Ohio doctors are concerned about the case’s local impact on emergency abortion care.

By Susan Tebben, Ohio Capital Journal - April 23, 2024

House GOP votes to end flu, whooping cough vaccine rules for foster and adoptive families

A bill to eliminate flu and whooping cough vaccine requirements for adoptive and foster families caring for babies and medically fragile kids is heading to the governor’s desk.

By Anita Wadhwani, Tennessee Lookout - March 26, 2024

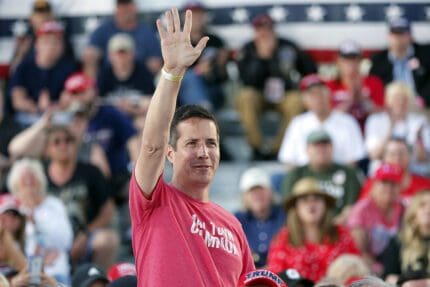

U.S. House Speaker Johnson says IVF should be protected — just not by Congress

U.S. House Speaker Mike Johnson said Thursday that it’s up to states and not Congress to preserve access to in vitro fertilization, weighing in on a growing national debate and campaign issue.

By Jennifer Shutt, States Newsroom - March 14, 2024