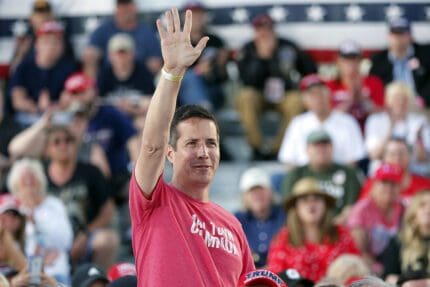

GOP Senate nominee Ted Budd sided with payday lenders as he took their PAC donations

North Carolina Republican Rep. Ted Budd opposed consumer protections against predatory lending, despite his own state prohibiting the practice.

North Carolina Republican Senate nominee Ted Budd has consistently sided with predatory lenders and the payday lending industry, even though payday lending is banned in his state. The industry has rewarded him with thousands of dollars in campaign contributions.

Budd, currently serving his third term in the U.S. House of Representatives, is running against former North Carolina Supreme Court Chief Justice Cheri Beasley (D) this November for the open seat of retiring Republican Sen. Richard Burr. He calls himself a “liberal agenda crusher” who “will work for everyday families, not the elite or political insiders.”

But Budd’s record indicates otherwise. He has consistently supported lenders who prey on lower-income individuals using abusive repayment terms and exploitative tactics, practices that have been illegal in North Carolina for more than 20 years.

Many financial services companies offer payday or “cash advance” loans, short-term loans carrying a high interest rate based on anticipated income coming on the borrower’s next payday.

North Carolina is among the states that have cracked down on these practices. According to its Justice Department, “North Carolina has some of the toughest laws against unfair loans in the nation and was the first state to adopt a comprehensive law against predatory home loans.”

The state has prohibited payday loans since 2001. After state officials closed a loophole in 2006, payday lending shops stopped operating in the state entirely.

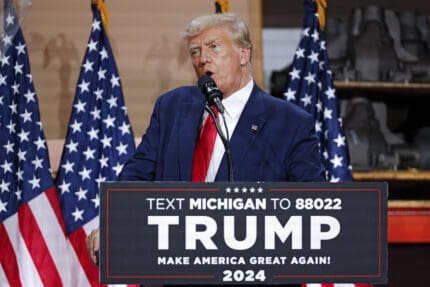

Republicans in Washington, D.C., have pushed to overrule those and other state regulations, at the behest of the lending industry. A rule enacted at the end of 2020 by then-President Donald Trump’s administration allowed lenders to partner with banks from other states to avoid state restrictions.

The Democratic majorities in the House and Senate overturned the Trump administration rule in 2021. Budd and almost every other Republican voted to keep it in place.

In March 2018, Budd signed on as a co-sponsor of an effort to repeal a Consumer Financial Protection Bureau rule cracking down on payday, car title, and other high-cost loans.

In July 2020 and again in February 2021, Budd introduced a “Freedom from Regulations Act” that would have placed limitations on the actions of independent agencies, including the Consumer Financial Protection Bureau.

His spokesperson told the right-wing Epoch Times after the initial bill was filed that the effort was “focused on some of the most far-reaching and economically impactful regulations that independent agencies have implemented, like the CFPB’s 2017 payday lending rule, the FCC’s ‘net neutrality’ rule, the NLRB’s joint-employer rule.”

As Budd repeatedly sided with payday lenders, payday lenders repeatedly filled his campaign coffers.

He received at least $2,500 from the Community Financial Services Association of America PAC, the political arm for the payday lending industry’s trade association. A spokesperson for the group did not immediately respond to an inquiry about the donations.

Budd’s June 2022 campaign finance report noted thousands of dollars in PAC contributions from payday lending companies.

Some of the industry donations he received came within days of a key vote.

On May 4, 2017, Budd voted to advance the Financial CHOICE Act of 2017 out of the House Financial Services Committee. The package, which was mostly aimed at rolling back the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, included a section determining that the Consumer Financial Protection Bureau “may not exercise any rulemaking, enforcement or other authority with respect to payday loans, vehicle title loans or other similar loans.”

“They’re trying to sneak in that provision,” Diane Standaert, then executive vice president at the Center for Responsible Lending, told the Los Angeles Times. “It seems like they hoped no one would notice.”

Several financial company executives donated to Budd that month, including at least one payday lender.

On May 31, he received $1,000 from Scott Wisniewski, the CEO of Western Shamrock Corporation, which offers paycheck advance loans and has been called a “predatory lender” by the advocacy group Texans for Public Justice.

A spokesperson for the company did not immediately respond to a request for comment.

Democratic nominee Beasley, who supports her state’s ban, told the American Independent Foundation in an emailed statement, “Payday lenders have a long record of taking advantage of hard-working Americans, and it’s unacceptable that Washington politicians like Ted Budd chose to take their campaign contributions instead of holding them accountable. In the Senate, I will always stand up to corporate special interests to protect North Carolinians from predatory lenders.”

Budd has a history of siding with his donors over his North Carolina constituents.

He accepted contributions from pharmaceutical interests within days of voting against a bill to lower prescription drug prices in 2019 and took cash from the oil and gas sector a day before voting not to prohibit price gouging by the industry.

Budd’s spokespeople did not respond to an inquiry for this story.

Published with permission of The American Independent Foundation.

Recommended

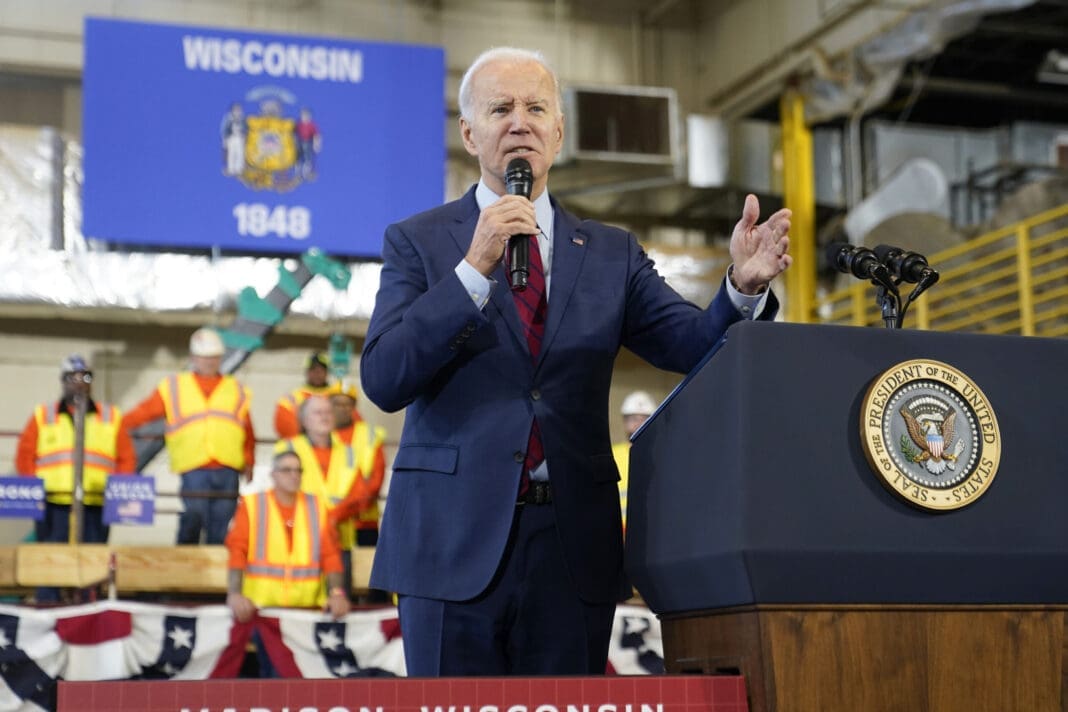

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

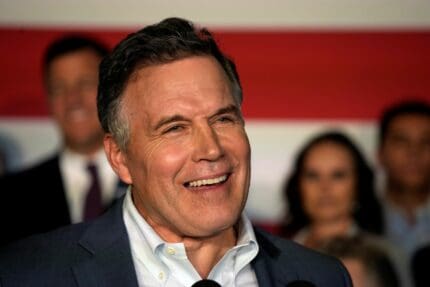

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023