GOP senators who added trillions to national debt demand 'balanced budget' amendment

Their proposal would make it virtually impossible to raise the needed revenue to pay for even current expenses.

Nine Republican senators introduced a proposed constitutional amendment on Wednesday that would both require a balanced federal budget and make it nearly impossible for the government to maintain even current levels of spending.

The resolution, backed by Sens. Cindy Hyde-Smith (MS), Marcia Blackburn (TN), Mike Crapo (ID), Joni Ernst (IA), Deb Fischer (NE), John Hoeven (ND), Jim Risch (ID), Marco Rubio (FL), and Thom Tillis (NC), would bar the federal government from spending more than it takes in in a given year.

While the proposed amendment would allow Congress to waive the balanced budget rules “for any fiscal year in which a declaration of war against a nation-state is in effect,” it makes no exception for pandemics.

Every one of the sponsors voted to add trillions to the debt last year in emergency COVID-19 relief spending. Had this rule been in place, such action would have required a two-thirds vote in the House and Senate. The amendment contains exceptions only for cases of foreign wars or for situations where two-thirds of both congressional chambers deem it essential.

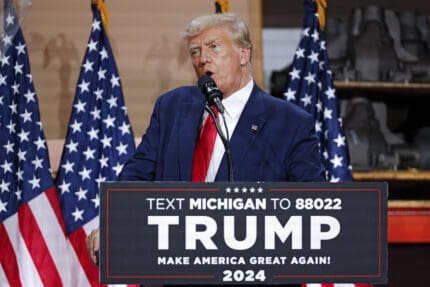

But in 2017, Blackburn, Crapo, Ernst, Fischer, Hoeven, Risch, Rubio, and Tillis each voted for the Tax Cut and Jobs Act, Donald Trump’s legislation to cut taxes significantly for big business and the very wealthy.

They voted for this bill, despite knowing that it would raise deficits. According to the nonpartisan Tax Policy Center, the law will likely “add $1 to $2 trillion to the federal debt” in its first decade by reducing revenue.

With declining tax revenue and massive new spending to address the coronavirus pandemic, the federal budget deficit for 2020 was an estimated $3.3 trillion, up from about $1 trillion the year before. To get that down to zero, as the amendment would require, Congress would either have to slash spending, increase tax revenue, or do some combination of the two.

But another provision of this group’s proposal would make the second and third options virtually impossible: The amendment would require a two-thirds supermajority in both the House and Senate for the federal government to ever again raise taxes.

With the vast majority of congressional Republicans on record promising to oppose virtually any increase to individual or business tax rates, such a vote would be highly unlikely, meaning huge cuts to government programs would be required.

Yet another provision of this amendment would require a three-fifths vote in Congress to raise the federal debt limit, which would make it vastly more difficult to avoid default on the growing national debt. Several votes to increase the limit in recent years have been by a narrow majority. Experts say a default would be disastrous for the U.S. economy, which could further reduce revenue.

In a statement, Fischer explained her support for the “balanced budget” resolution, writing: “To ensure that our nation is fiscally responsible, Congress must stop budgeting crisis to crisis. Families in Nebraska and across the country have to make difficult decisions about their own budgets, and it is far past time for Congress to do the same.”

Published with permission of The American Independent Foundation.

Recommended

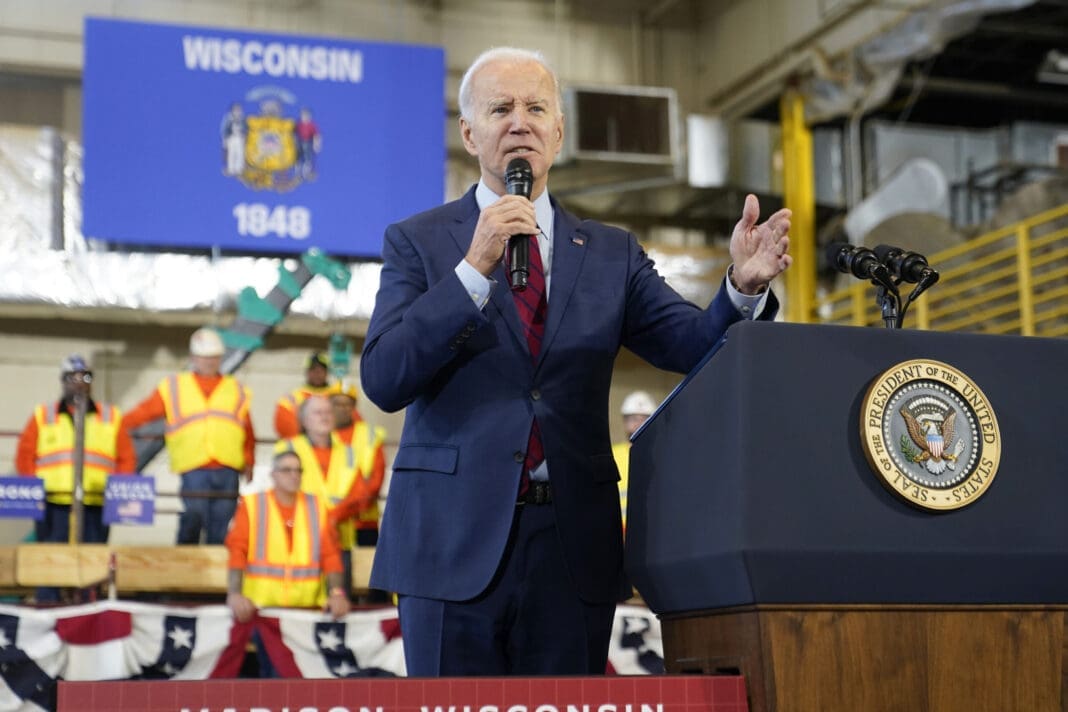

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

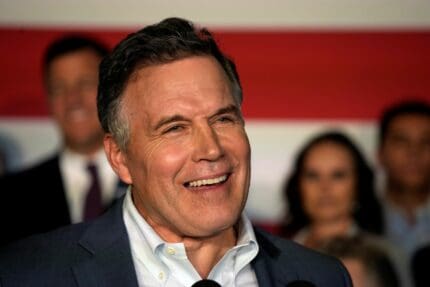

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023