House Republicans want to repeal state and federal taxes on the sale of firearms

There have already been 60 mass shootings in the United States in 2023. Republican lawmakers want to make guns even cheaper to obtain.

In the first five weeks of 2023, there have already been more than 4,200 deaths from gun violence in the United States and at least 60 mass shootings — a rate of more than one per day — according to the Gun Violence Archive. Rather than take action to curb the proliferation of firearms, House Republicans are proposing a tax cut for gun transfers.

On Thursday, Rep. Ashley Hinson (R-IA) and 17 GOP colleagues reintroduced the Repealing Illegal Freedom and Liberty Excises (RIFLE) Act, a bill that would repeal the federal firearms transfer tax. Existing law, which was passed in 1934, calls for a $200 excise tax on transfers of some guns and silencers, an amount that has not been changed since the law was enacted.

When Hinson proposed the same bill in May 2021, she falsely claimed that the tax violates the Constitution: “The federal government should not be placing financial barriers on the inalienable rights of Americans. This unconstitutional tax on certain firearm purchases is a direct violation of the Second Amendment and must be repealed.”

The Second Amendment to the U.S. Constitution states, “A well regulated Militia, being necessary to the security of a free State, the right of the people to keep and bear Arms, shall not be infringed.” It does not say anything about taxation of the sale of weapons.

Chelsea Parsons, an expert on gun violence who is now the director of implementation for Everytown for Gun Safety, told the American Independent Foundation at the time that the bill was “an effort to undermine a nearly 90-year-old law that has successfully protected U.S. communities from the significant harm caused by fully automatic machine guns. … At a time when gun violence is devastating communities across the country, our elected leaders should be focused on developing solutions to that problem, not carrying the water for the gun industry.”

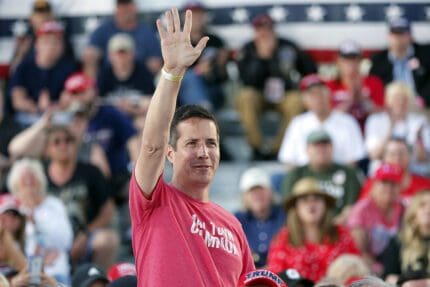

On Jan. 17, Rep. Ronny Jackson (R-TX) reintroduced the No User Fees for Gun Owners Act, which would prohibit any state or local government from imposing any “liability insurance, tax, or user fee requirement for firearm or ammunition ownership or commerce.” Thirty representatives — all Republicans — have already signed on as co-sponsors. It was previously introduced in 2022.

Jackson, in a Jan. 20 press release, framed his bill as “legislation to defend gun owners from anti-Second Amendment policies.” He charged that Democratic lawmakers around the country were passing ‘the worst anti-gun legislation this country has ever seen” and abandoning local police departments.

The bills come as gun violence continues to be a national problem. Last month, a gunman killed 10 people and injured 10 more at a Lunar New Year celebration in California. It was one of more than 50 mass shootings in January alone. Over the past decade, the United States saw a significant increase in the number of guns manufactured, along with record numbers of sales of firearms.

While House Republicans are pushing for Congress to address the national budget deficit, arguing for a balanced budget, neither of the firearms proposals offer a replacement for potential loss in revenue that would result from the elimination of the taxes.

“If Iowans can sit at the kitchen table and balance their checkbooks, so can Congress. I understand the value of a dollar and will make the tough decisions needed to push down the national debt, eliminate waste, and balance our country’s books,” Hinson proclaims on her official House website.

However, her bill includes no offset for the tens of millions of dollars in revenue that will be lost should the tax be repealed. According to the most recent data from the Bureau of Alcohol, Tobacco, Firearms and Explosives, more than $51 million in taxes were paid into the Treasury under the existing law in 2020, up from $37 million the year before.

Jackson’s bill similarly would do nothing to compensate state or local governments for any revenue they would lose under a national ban.

In the last Congress, the Democratic-controlled House passed legislation to require universal background checks for all gun purchases and implement a national “red flag” system to temporarily disarm those deemed a threat to themselves or others. The bills died in the Senate amid widespread GOP opposition.

Published with permission of The American Independent Foundation.

Recommended

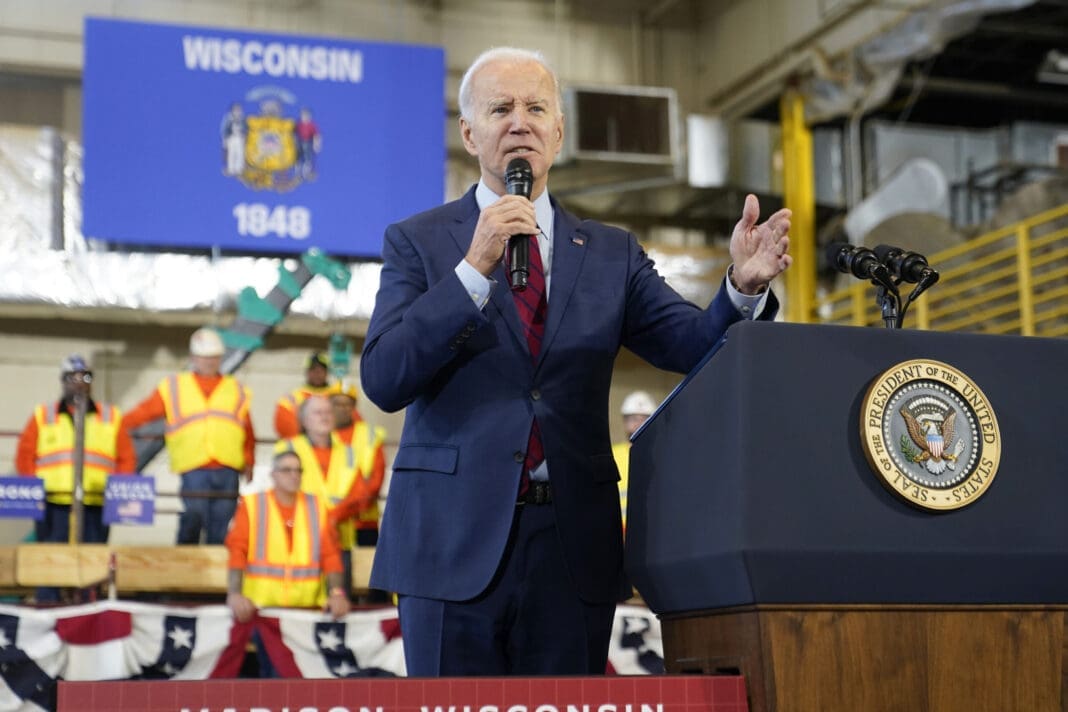

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

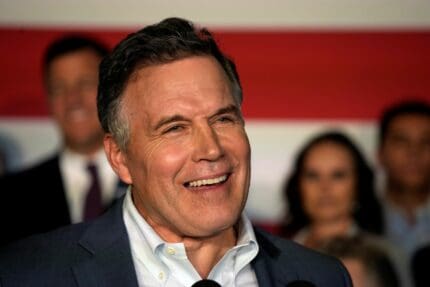

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023