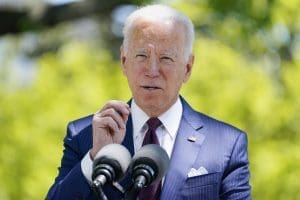

Big business wants to block Biden's tax hikes even though they're popular

Most Americans want to fund federal investment plans by taxing the rich and corporations.

The American public widely supports President Joe Biden’s proposals to raise taxes on the very rich and big businesses to fund investment in families and infrastructure. But the business community is lobbying hard to derail the proposals.

Much of the business lobby’s focus has been pressuring moderate Democrats to oppose tax increases. Neil Bradley, chief policy officer for the U.S. Chamber of Commerce, told Politico on Sunday that he does not believe most of Biden’s tax proposals have any chance of becoming law.

“You are talking about tax hikes that could hit millions of small businesses across the country and taxes that could kill investment,” he argued. “From a raw political perspective, it would be a really funky decision for these moderates to say they would be willing to put this much of a wet blanket on an economy that is really poised to take off.”

“I’ve been through a lot of the tax hike efforts, but now is a tough time for [Democrats] to get a lot of them done,” a former Democratic political operative told Politico. “The economy is clearly coming back, but it would be a weird time to slap more taxes on people.”

But polling shows the public is strongly behind collecting more taxes from businesses and from individuals making more than $400,000 annually, as Biden has urged.

According to a late April Monmouth University poll, 68% of American adults back Biden’s American Jobs Plan, with its proposed $2.25 trillion in investment in infrastructure, and 64% support his proposed funding mechanism of more revenue from corporations.

That survey also found 64% support for the investments in Biden’s American Families Plan, which would provide $1.8 trillion for free community college, paid family leave, health care, and child care, and 65% support for its funding source: increased taxes on the very wealthy.

A March Politico/Morning Consult poll found 54% of Americans want to increase taxes on corporations and the wealthiest Americans to pay for infrastructure investments, while 27% said the proposal should not be funded by tax increases. It also showed, by a 57%-17% margin, that increased taxes on those making more than $400,000 would make most Americans more likely to back the plan.

The proposed increases would represent a partial reversal of the massive tax cuts for companies and high-income earners included in Donald Trump’s 2017 Tax Cuts and Jobs Act. The corporate tax rate, which was 35% prior to the enactment of the Trump tax law, would go back up to just 28% under Biden’s plan. Trump’s plan was unpopular with the public and passed without a single Democratic vote.

Biden campaigned on an explicit promise to raise taxes on the wealthy, but not on anyone making less than $400,000 a year.

“Nobody making under 400,000 bucks would have their taxes raised, period, bingo,” he told CNBC in May 2020.

In a September debate against Trump, Biden explicitly said, “I’m going to eliminate the Trump tax cuts.” Five weeks later, he won the 2020 presidential election by more than 7 million votes, while Democrats held control in the House of Representatives and gained a narrow majority in the Senate.

Still, the GOP minority has vowed to unanimously oppose any legislation that raises those tax rates. Instead, they have floated proposals for “user fees” such as higher gas taxes and charges for those who drive electric cars to fund infrastructure spending.

Politico reported that Rep. Hakeem Jeffries (D-NY), chair of the House Democratic Caucus, said, “A user fee is a tax on working-class Americans, and we don’t support that.”

Under Congress’ budget rules, Democrats can pass both the American Jobs Plan and the American Families Plan without a single Republican vote — if they stay united. Biden is trying to negotiate a bipartisan agreement on infrastructure, while Democrats are trying to figure out where they can find consensus within their caucus on the rest. Some Democratic lawmakers have expressed reservations about the levels of tax increases, while others are demanding additional tax relief for those who pay high state and local taxes.

Contrary to the GOP’s and business lobbyists’ talking points, the White House does not believe the tax increases will hurt the economy.

“A lot of people are thinking about this the wrong way,” one unnamed source identified as close to the Biden administration told Politico. “The spending is over a long time frame and most of the taxes we are talking about would just return some fairness to the code and make those who are able to pay more to pay more. And we are talking about increasing long-term productivity and addressing a lot of structural problems in the economy.”

Experts agree. Reports by Moody’s Analytics and economists at the Georgetown University Center on Education and the Workforce suggest Biden’s jobs package would result in millions more jobs.

Published with permission of The American Independent Foundation.

Recommended

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023