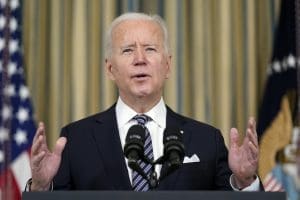

Fact check: No, Biden's plan to tax the rich won't hurt working Americans

The president is expected to propose partial repeals of Donald Trump’s tax cuts for big companies and wealthy individuals.

Congressional Republicans are falsely accusing President Joe Biden of planning to hike taxes on middle-class families, which he has explicitly promised not to do.

In a series of tweets this week, GOP lawmakers have complained about reports that the Biden administration is considering possible tax increases on corporations and very wealthy individuals as a way to pay for legislative priorities and claimed they would hurt ordinary Americans.

“After pushing a $2 trillion package with 91% for special interests, what is President Biden’s next move? The first major #TaxHike since 1993,” tweeted Rep. Vicky Hartzler of Missouri, incorrectly describing the contents of the American Rescue Plan. “As American families are just getting back on their feet from this pandemic, we should not be raising taxes.”

“DC has a SPENDING problem, not a revenue problem,” claimed South Carolina Rep. Nancy Mace. “Hurting the #AmericanWorker & businesses won’t fix it.”

“House Democrats want to fund their socialist agenda by raising taxes on American families and businesses,” warned Oklahoma Rep. Markwayne Mullin.

“Biden is now planning a tax hike as if the prices of gas soaring and the food prices going up weren’t enough,” said Colorado Rep. Lauren Boebert. “The middle class is getting HAMMERED right now!”

But Biden is not planning to increase taxes on the middle class.

According to a Bloomberg report on Monday, the president is expected to propose partial repeals of Donald Trump’s 2017 tax cuts for big companies and individuals making more than $400,000 annually.

White House economist Heather Boushey told Bloomberg TV that Biden wouldn’t raise takes on anyone earning less than that. “Folks at the top who’ve been able to benefit from this economy and haven’t been this hard hit — there’s a lot of room there to think about what kinds of revenue we can raise,” she explained.

The increases would be used to offset some of the costs of an upcoming infrastructure and jobs package and would largely be exactly what Biden promised as a candidate, when he ran on tax increases for the rich.

“I will raise taxes for anybody making over $400,000,” he told ABC News in August 2020. “No new taxes, there would be no need” for those making below that amount, he said.

“Nobody making under 400,000 bucks would have their taxes raised, period, bingo,” he told CNBC that May.

And in his presidential debates against Trump, Biden was clear: “I”m going to eliminate the Trump tax cuts.”

Trump tried to use the promise against him, saying, “I’m cutting taxes and he wants to raise everybody’s taxes.”

But the American voters picked Biden over Trump by a 7 million vote margin.

Some of the Republicans who are now upset about the prospect of Biden keeping his promise to increase revenue also objected to the lack of offsets for the $1.9 trillion pandemic relief law passed last week.

“Democrats are acting like their wasteful spending isn’t causing inflation, yet prices of everyday goods are already rising,” tweeted Sen. Rick Scott of Florida on Monday. “Now they want to raise taxes on already struggling families & businesses? Americans & our nation’s economy cannot afford this reckless behavior.”

Scott warned last Tuesday that America had reached “a day of reckoning” with its national debt because of the increased deficits from the plan.

Rep. Mike Turner (R-OH) tweeted on Tuesday, “This is not the time to raise taxes. This is the time for recovery.”

Back in 1993, Republicans in Congress unanimously opposed President Bill Clinton’s tax increases that mostly applied to high-income Americans and corporations.

At the time, they made similar arguments that changes would undermine the recovery and hurt everyone. After it became law, the nation saw its longest period of peacetime economic expansion in history.

Published with permission of The American Independent Foundation.

Recommended

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023