GOP ignores report showing Biden plan would cut taxes for the middle class

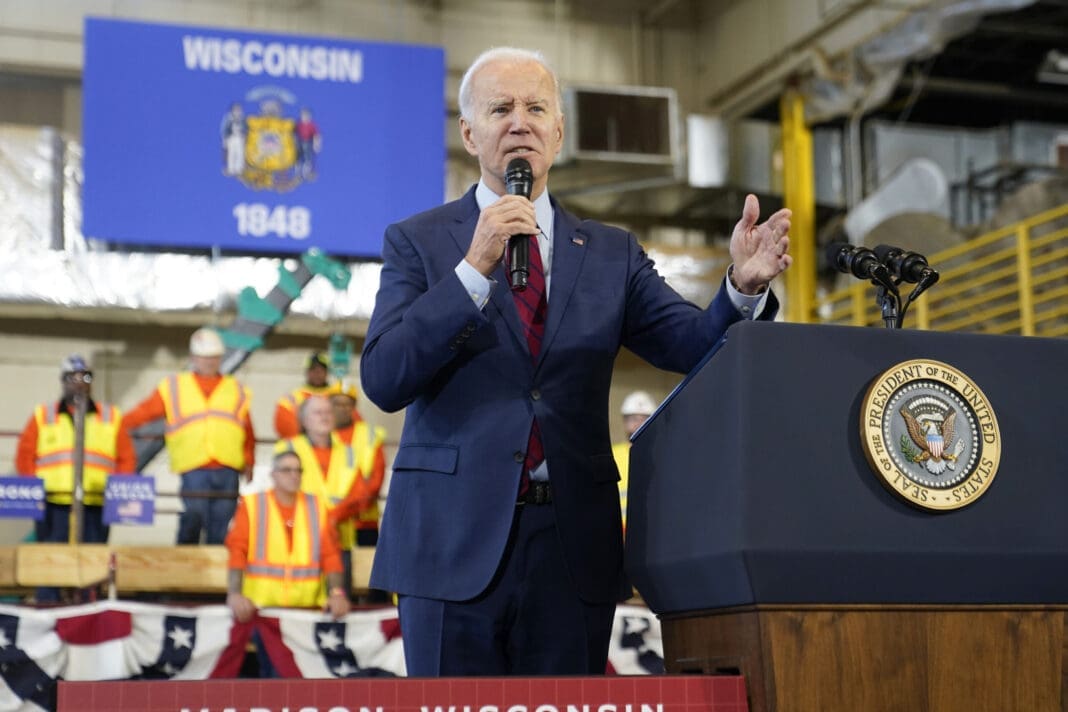

A nonpartisan congressional analysis found the Build Back Better plan would cut taxes for Americans making under $200,000.

A new analysis from Congress’ nonpartisan Joint Committee on Taxation released Tuesday found that President Joe Biden’s proposed Build Back Better investment plan would cut taxes for middle-class Americans. But GOP lawmakers continue to falsely claim that the $3.5 trillion package would including “crippling tax hikes” for working families.

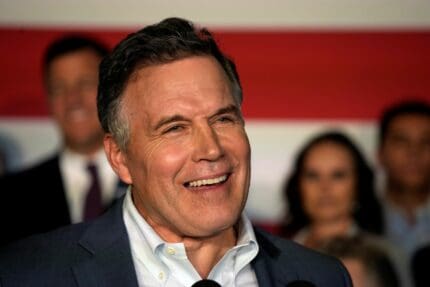

On Tuesday, Republicans on the House Ways and Means Committee posted on their website a “fact check” by the ranking member of the committee, Texas Rep. Kevin Brady. The document warned that “Democrats will raise taxes on the middle class, small businesses, reversing benefits of TCJA,” the 2017 Tax Cuts and Jobs Act that Brady authored. That legislation drastically reduced taxes on the very wealthy and on corporations, while actually raising taxes on 10 million American families.

The Texas Republican accused Biden of breaking his “pledge not to raise taxes on the middle class,” arguing that increased corporate tax burdens would eventually be “borne by lower- and middle-income taxpayers.” But while businesses may ultimately pass on some of the cost of those tax increases to their workers and shareholders, that does not make them a tax increase on the middle class.

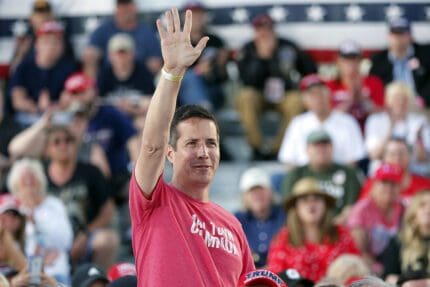

On Wednesday, Pennsylvania Rep. Lloyd Smucker tweeted a link to Brady’s claims, writing, “My House Democrat colleagues continue to share falsehoods about their disastrous tax-and-spend agenda. Here are the facts about how middle-class Americans will be impacted.”

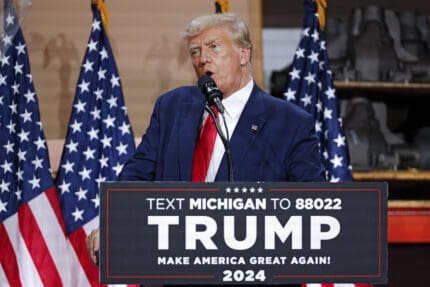

Republicans have been dishonestly claiming for months that Biden’s proposals to raise income taxes of those earning more than $400,000 annually and on big businesses would somehow “destroy the middle class.”

That claim is flatly contradicted by the score given by the nonpartisan Joint Committee on Taxation, which, according to its website, “operates with an experienced professional staff of Ph.D economists, attorneys, and accountants, who assist Members of the majority and minority parties in both houses of Congress on tax legislation.”

According to the committee’s “Distributional Analysis of the Estimated Budgetary Effects” of the revenue provisions in the $3.5 trillion plan, federal taxes would drop for Americans in every income category under $200,000 a year.

Those making less than $10,000 would see their federal taxes drop by more than 256%, thanks to tax credits aimed at reducing poverty. Americans earning under $50,000 a year would see a tax cut of more than 10%.

Those in the $100,000-to-$200,000 income range would see savings of about 1.8%.

While the report found those earning between $200,000 and $500,000 annually would see a tiny increase of 0.3%, that bracket includes some individuals earning more than $400,000, the very people whose taxes Biden has repeatedly vowed to raise.

It also shows that the investment bill would raise taxes on the people at the very top: Those making $1 million or more would see an estimated tax increase of 10.6%.

The Build Back Better plan would use this new revenue to pay for climate change and clean energy infrastructure as well as child care, health care, paid family leave, and free community college and preschool.

Polling has consistently shown broad public support for both the tax increases and the investments.

Still, the Ways and Means Committee Republicans are dismissing it as a “$3 trillion tax hike and spending spree,” and not a single Republican in the House or Senate is supporting it.

Published with permission of The American Independent Foundation.

Recommended

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023