Dark money ads falsely claim Biden plan will tax middle-class families '$10,400'

The conservative Club for Growth is running dishonest spots in six targeted House districts.

A conservative dark money group is running false ads opposing President Joe Biden’s jobs bill in six swing House districts. The spots dishonestly call the plan’s tax increases on the richest Americans a “middle class tax hike.”

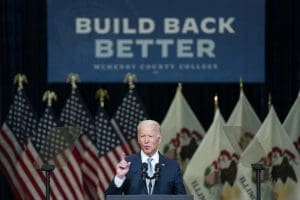

The Club for Growth announced last week that it will spend $250,000 to run spots urging Democratic Reps. Cindy Axne (IA), Carolyn Bourdeaux (GA), Jared Golden (ME), Chris Pappas (NH), Kurt Schrader (OR), and Abigail Spanberger (VA) to oppose the $3.5 trillion Build Back Better plan.

The ad targeting Pappas claims:

Nancy Pelosi and Chris Pappas want the IRS to keep an eye on you. Pelosi’s middle-class tax hike could cost your family $10,400. And it gets worse: Pelosi and Pappas would require your bank to report to the IRS all of your transactions, as low as $600. Does Pappas really want higher taxes and more IRS snooping? Remind Pappas he works for you. Tell him to stop Pelosi’s middle-class tax hike.

The other ads are basically identical, except for the names and state-level estimates.

The $10,400 is sourced to an analysis by the conservative Tax Foundation examining the tax provisions of Biden’s proposals on states and congressional districts. Their assessment suggests that the average New Hampshire tax filer will see a tax increase of about $1,039 each year for the next decade — $10,389 total. The ad makes no mention of the fact that this would be a 10-year total.

And with an estimated 45,000-plus millionaires in the state — more than 8% of all households — according to a 2020 Kiplinger analysis, that average is highly misleading.

As Biden has promised since his 2020 campaign, the plan would not increase taxes on anyone making less than $400,000 a year. In fact, lower- and middle-income families would likely receive a federal tax cut from the legislation.

A September analysis by Congress’ nonpartisan Joint Committee on Taxation examined the plan’s revenue provisions. It’s “Distributional Analysis of the Estimated Budgetary Effects” indicates that federal taxes would be reduced for those in every income category under $200,000 a year.

With a median household income of about $77,000, a typical New Hampshire family would pay less, not more, in annual federal taxes.

Those making $1 million or more would see about a 10.6% tax increase.

That new revenue would go to pay for child care, health care, paid family leave, free community college and preschool, climate change, and clean energy infrastructure.

The “snooping” claims in the ad are also misleading. Provisions in the bill aimed at cracking down on wealthy tax evaders would allow the Internal Revenue Service access to some additional bank data. But contrary to the Club for Growth’s claim, it would only require banks to report annual account transaction totals for accounts over $600 — not all the individual transaction details — according to September USA TODAY and PolitiFact fact checks.

That would allow the IRS to stop wealthy tax dodgers from gaming the system and collect some of the hundreds of billions owed and not collected each year. Experts say it would also mean fewer audits for honest lower- and middle-income earners and better-targeted enforcement for high earners who don’t report their true income.

While the Club for Growth does not disclose its donors, its affiliated political committees have received millions of dollars from wealthy conservative donors — the very people who would actually see their taxes go up under Biden’s proposal.

“Despite what Speaker Pelosi is trying to sell House Democrats, the fact is people will reject this massive tax and spend, government spying legislation,” Club for Growth President David McIntosh, a former Republican representative from Indiana said in a press release.

But polls indicate the exact opposite. A Navigator Research poll released Friday found more than three-fifths of registered voters support the plan — and 75% back its tax hikes on the wealthy and corporations.

Published with permission of the American Independent Foundation.

Recommended

Biden on abortion rights: President expects to give speech Tuesday on new Florida 6-week ban

‘Having the president of the United States speaking out loud and with confidence about abortion access is a great thing’

By Mitch Perry, Florida Phoenix - April 22, 2024

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

Biden rallies Democrats in Las Vegas: ‘Imagine the nightmare’ if Trump reelected

With a primary win all but inevitable, President Joe Biden used his Sunday appearance in Las Vegas’s Historic Westside to rally his most vocal supporters in a battleground state that delivered for him four years ago.

By April Corbin Girnus, Nevada Current - February 05, 2024