Senator who didn't want poorest in US to get child tax credit now says it isn't big enough

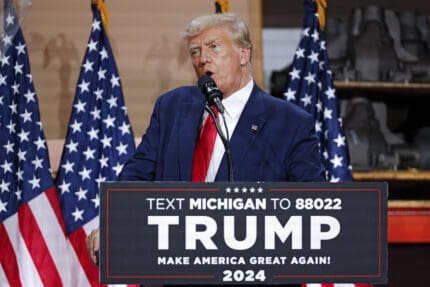

Mike Lee and every other Senate Republican voted against the law that is helping 92% of American families with children.

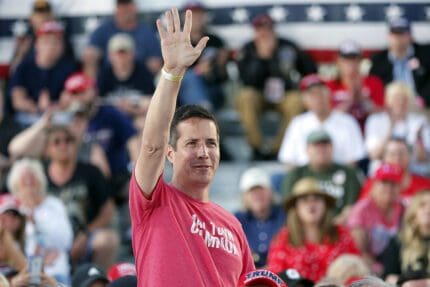

Sen. Mike Lee (R-UT) attacked Democrats on Friday for not making a new Child Tax Credit expansion even larger. But he and every congressional Republican voted against even passing the current amount.

“If you’re one of the 39 million households receiving their first Child Tax Credit payment today, don’t forget that every single Democrat voted against making it larger,” he tweeted.

He was reacting to a tweet by former Secretary of Labor Robert Reich about the tax rebate that millions of American parents received on Thursday, thanks to President Joe Biden’s American Rescue Plan. The rebates were implemented despite the unanimous opposition of Republicans in the House and Senate.

“The Lee-@SenRubioPress amendment would have ensured that the credit goes to taxpayers, and would have resulted in monthly advances of $290-$375,” the Utah Republican added. “If Democrats had broken rank, working families would be in a stronger position today.”

According to the independent Tax Policy Center, an estimated 92% of families with children will be eligible for the expanded Child Tax Credit in 2021 and will save an average of $4,380 (up from $2,310 before). Half of the credit will be paid out via six monthly rebate payments from the Internal Revenue Service over the second half of 2021.

Lee and Sen. Marco Rubio (R-FL) did propose making the total tax credit slightly larger, but with a significant caveat: They did not want to give the credit to the poorest American families. Instead, they sought to restrict it to only “working parents with children.”

“We do not support turning the Child Tax Credit into what has been called a ‘child allowance,’ paid out as a universal basic income to all parents,” they said in their February joint press release. “That is not tax relief for working parents; it is welfare assistance.”

“An essential part of being pro-family is being pro-work,” the pair argued. “Congress should expand the Child Tax Credit without undercutting the responsibility of parents to work to provide for their families.”

The Democratic majority rejected the suggestion from Lee and Rubio and instead enacted a credit for virtually all parents making less than $240,000 in adjusted gross income (for a single or head-of-household filer) or $440,000 for a couple filing jointly — as long as they have a dependent child under age 18 or a dependent full-time college student under age 25.

The credit was part of Biden’s $1.9 trillion pandemic relief package, which also provided $1,400 relief checks for most Americans, expanded unemployment benefits to those out of work due to the pandemic, and $350 billion in direct aid to cash-strapped state and local governments.

Lee’s home state of Utah received an estimated $2.7 billion from the law. According to the Center for Budget and Policy Priorities, about 860,000 Utah kids will benefit from the expanded tax credit.

But like his GOP colleagues, Lee opposed the legislation, dismissing it as “a partisan grab bag of special interest handouts” and as a “bloated, wasteful bill” that was “written for the Democratic Party.”

On Thursday, about $15 billion in Child Tax Credit payments were sent out to 35.2 million American families. The average payment was $423.

While the current program will run through 2021, Democratic lawmakers and the president are pushing to continue it via future legislation.

Published with permission of The American Independent Foundation.

Recommended

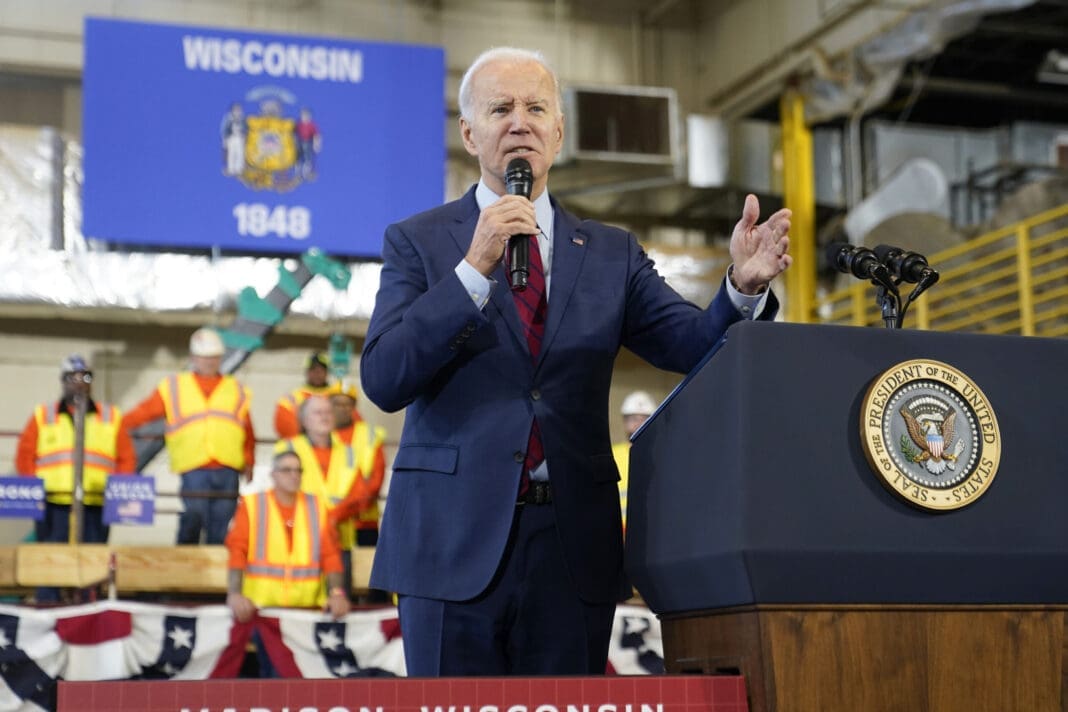

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023