Biden administration forgives $3.9B in loans to students ripped off by for-profit colleges

Under Biden, the Department of Education has forgiven nearly $32 billion in student debt thus far.

The Department of Education announced on Tuesday that the $3.9 billion in federal student loans owed by 208,000 borrowers who attended the ITT Technical Institute would be discharged.

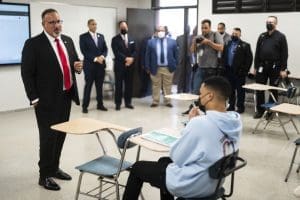

“The evidence shows that for years, ITT’s leaders intentionally misled students about the quality of their programs in order to profit off federal student loan programs, with no regard for the hardship this would cause,” Education Secretary Miguel Cardona said in a statement.

“The Biden-Harris Administration will continue to stand up for borrowers who’ve been cheated by their colleges, while working to strengthen oversight and enforcement to protect today’s students from similar deception and abuse.”

ITT Technical Institute closed in 2016 after the federal government prohibited the use of federal loans to pay for tuition at the for-profit institution. The chain of schools had been under scrutiny from the Obama administration after allegations of predatory business practices surfaced.

Studies showed that many of the students who attended the school ended up in jobs without the increase in income that ITT’s aggressive recruiters had promised them. Those students, who were often from low-income backgrounds, were then saddled with massive student loans.

The Department of Education also announced it had formally notified another for-profit institution, DeVry University, that it is liable to the department for nearly $24 million in borrower defense payments. The department noted in its statement that DeVry had claimed that 90% of its graduates obtained jobs in their field of study within six months of graduating, but that the real statistic was closer to 58%. In February, the Biden administration approved $71 million in debt forgiveness for former DeVry students.

The department also declared that the loans that about 100 borrowers who attended the for-profit Kaplan Career Institute would have their loans discharged as well, citing similar false claims about graduation rates.

The department noted that since Biden took office, nearly $32 billion in student loan relief has been approved, including $13 billion for borrowers who were taken advantage of by for-profit institutions.

In addition to his administration’s actions on for-profit student loans, President Joe Biden in April extended the pause of student loan repayments that was put in place due to the COVID-19 pandemic. In June, Biden said another extension of the pause was “on the table,” as is possible forgiveness of some student loans.

This administration’s actions are stark in comparison to the policies of the Trump administration, which were far more hostile to defrauded students seeking relief.

Betsy DeVos, who served as former President Donald Trump’s education secretary, frequently used her position to advocate on behalf of the interests of for-profit schools. On 2019, DeVos repealed a federal rule put in place by the Obama administration designed to crack down on for-profit schools who defrauded their students.

Toby Merrill, director of the Project on Predatory Student Lending, told NPR at the time that “The Department of Education under Secretary DeVos has gone above and beyond to deny relief to borrowers cheated by for-profit colleges.”

DeVos’ actions validated many concerns expressed before her Senate confirmation of her close ties to the for-profit education industry, including personal investments she made in for-profit schools.

Recommended

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023