Workers laid off during pandemic now at mercy of predatory lenders

Advocates fear that unscrupulous banks and lenders will take advantage of people experiencing a temporary loss of income and lure them into financial hardship that lasts years.

As the economic fallout from the COVID-19 pandemic continues, millions of people are finding themselves in situations that make them susceptible to financial predators.

As many as 1 in 5 workers filed for unemployment in some states through the first half of April, the Wall Street Journal reported. Millions of people said they wouldn’t be able to make rent that month.

Problems with the disbursement of stimulus money by the IRS have left many people still waiting to receive payments.

Consumer advocates say that the situation is ripe for the kinds of financial abuses and difficulties encountered during the 2008 financial crisis, which saw more than 3 million foreclosures and millions of lost jobs.

Chris Peterson, a former top regulator at the Consumer Financial Protection Bureau and professor of law currently running for governor of Utah, says that the infrastructure put in place in the wake of the 2008 financial crisis is not being used, leaving millions of vulnerable people at risk.

“When people are afraid or desperate, they’re less effective at shopping carefully and weighing options,” Peterson said. “There is a temptation to just find the first option that seems acceptable and jump on it.”

Stress has been shown to worsen financial decision-making. When they’re stressed, people are likely to be too conservative when faced with good options and too bold when faced with riskier ones.

Peterson noted that without a robust consumer protection agency monitoring the financial industry, highly stressed consumers dealing with job losses and debts are easy marks for those pushing predatory loans, debt traps, and outright scams.

“The CFPB is not engaging in meaningful oversight,” he said. “The problems could be … as simple as more fees associated with their checking account, and therefore losing out on some wealth. But it can go all the way to home mortgage foreclosure and eviction. [In the aftermath of the 2008 crisis,] we saw a nationwide spike in the number of homeless people, including homeless children.”

As an example of the CFPB’s passivity and its potential consequences, Peterson pointed to the lack of clarity around the 60-day foreclosure suspension enacted in March as part of Congress’ coronavirus relief package, known as the CARES Act.

In the short term, suspending foreclosures can help keep people in their homes. But what the provision didn’t do was create clarity over borrower obligations for anyone claiming hardship who went into forbearance and temporarily stopped making payments.

Peterson pointed out that borrowers had to scramble to find answers to whether their payments would be waived entirely or simply deferred. Would the borrower be liable for the payments and extra fees later on, and for how much? Would the term of the loan be extended or would the payments be increased?

“Not knowing the answers to those questions could be the difference in whether or not they lose their home,” Peterson said.

In some cases, the lack of clarity has empowered financial institutions to write their own rules, as was the case when Treasury Department officials essentially deferred to the banks on the matter of whether stimulus payments could be withheld to cover debts or overdrafts, the American Prospect noted.

Of the $3,400 in relief paid by the government to one out-of-work landscaper and his family of four, for example, his bank kept all but $611 to cover fees resulting from a scam he’d fallen prey to, the New York Times reported.

“They’re very happy to cause a lot of harm where it’s hard to exactly pinpoint blame,” said Ian Madrigal, an activist and consumer advocate.

Advocates fear that unscrupulous banks and lenders will take advantage of people experiencing a temporary loss of income and lure them into financial hardship that lasts years.

With interest rates in excess of 100%, repayment of the average payday loan can take more than a third of a borrower’s paycheck. If they can’t make that payment, they often end up taking out another short-term loan, locking them in a cycle of debt.

The Consumer Financial Protection Bureau isn’t simply ignoring such predatory lending, it’s making the problem worse through a process of rule-making aimed at rolling back requirements that payday lenders ensure borrowers can actually repay the loans they take out.

“Unlike Wall Street banks and mainstream financial institutions, payday lenders have zero concern about shareholders or their reputation,” said consumer advocate Madrigal. “People are distracted, not just consumers but also the people who are trying to do the regulating, and who likely have more pressing things to deal with right now.”

Payday lenders will be looking at a flush few years if the CFPB remains idle, he suggested.

Published with permission of The American Independent Foundation.

Recommended

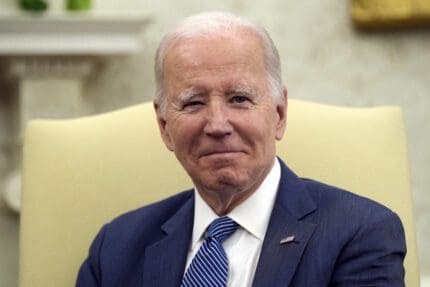

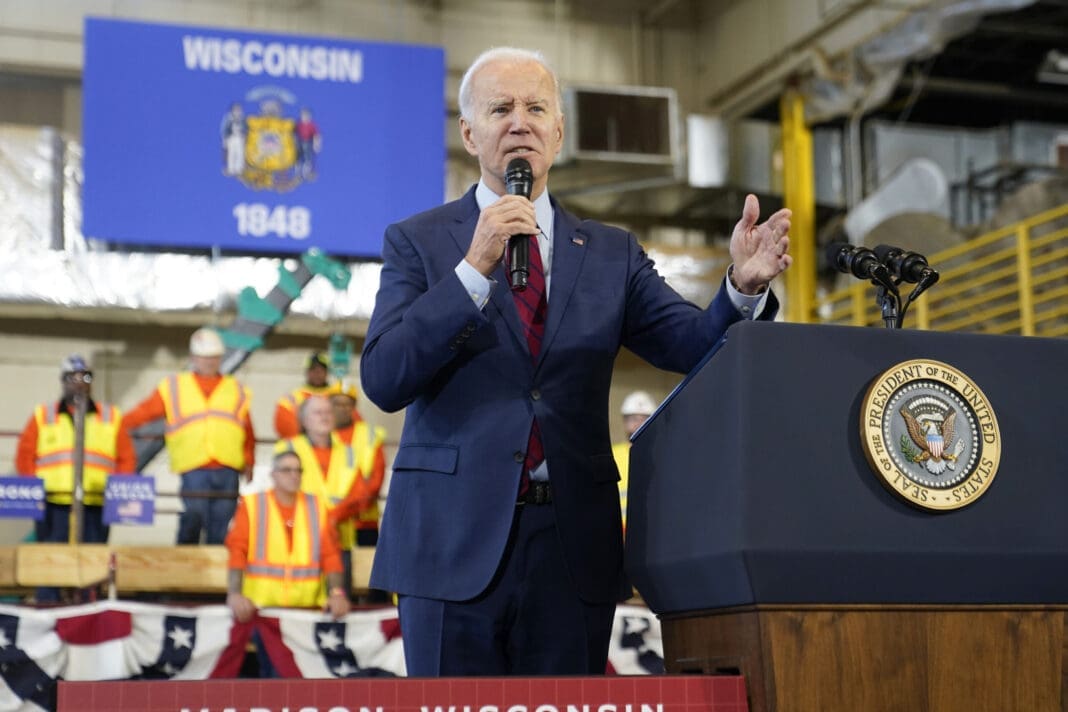

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

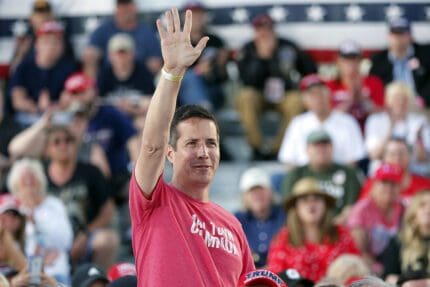

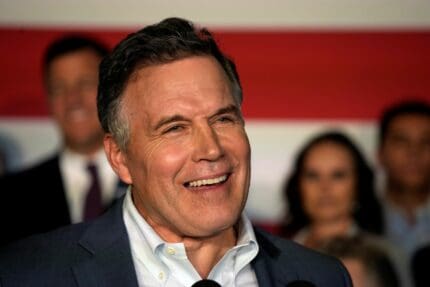

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023