Fewer Americans applied for jobless benefits last week

Unemployment rates have held steadily for months at the lowest marks since before the pandemic.

WASHINGTON (AP) — Fewer Americans applied for jobless benefits last week, but the previous week’s number was revised upward significantly, with claims breaching the 250,000 level in back-to-back weeks for the first time in more than eight months.

Applications for jobless aid for the week ending July 23 declined by 5,000 to 256,000 from the previous week’s 261,000, the Labor Department reported Thursday. The number of claims for the week of July 16 was revised upward by 10,000 from the previous estimate of 251,000.

First-time applications generally reflect layoffs.

The four-week average for claims, which smooths out some of the week-to-week volatility, rose by 6,250 from the previous week, to 249,500. That number is also at its highest level since November of last year.

The total number of Americans collecting jobless benefits for the week ending July 16 fell by 25,000 from the previous week, to 1,359,000. That figure has been near 50-year lows for months.

Earlier this month, the Labor Department reported that employers added 372,000 jobs in June, a surprisingly robust gain and similar to the pace of the previous two months. Economists had expected job growth to slow sharply last month given the broader signs of economic weakness.

The unemployment rate remained 3.6% for a fourth straight month, matching a near-50-year low that was reached before the pandemic struck in early 2020.

Earlier in July the government reported that U.S. employers advertised fewer jobs in May amid signs that the economy is weakening, though the overall demand for workers remained strong. There are nearly two job openings for every unemployed person.

Though the labor market is still considered strong, other indicators are pointing to some weakness in the U.S. economy. The government said Thursday that the U.S. economy shrank 0.9% in the second quarter, the second straight quarterly contraction.

Consumer prices are still soaring, up 9.1% in June compared with a year earlier, the biggest yearly increase in four decades. In response, the Federal Reserve raised its main borrowing rate by another three-quarters of a point on Wednesday. That follows last month’s three-quarter point hike and a half-point increase in May.

Those higher rates have already sent home sales tumbling, made the prospect of buying a new car more burdensome and pushed credit card rates up.

All of those factors paint a divergent and confusing picture of the post-pandemic economy: Inflation is hammering household budgets, forcing consumers to pull back on spending, and growth is weakening, heightening fears the economy could fall into recession.

Though the labor market is still strong, there have been some high-profile layoffs announced recently by Tesla, Netflix, Carvana, Redfin and Coinbase.

Recommended

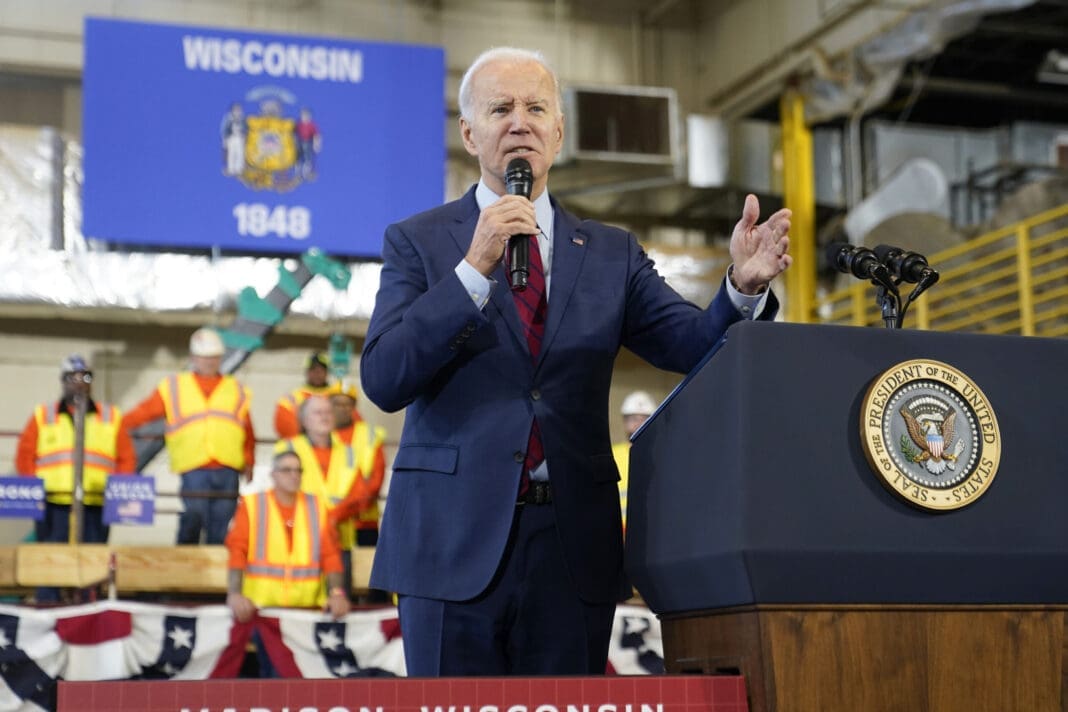

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023