Kushner sells stake in firm after criticism over potential conflict

The company received tax breaks that Trump’s son-in-law Kushner himself pushed for, raising questions about conflicts of interest.

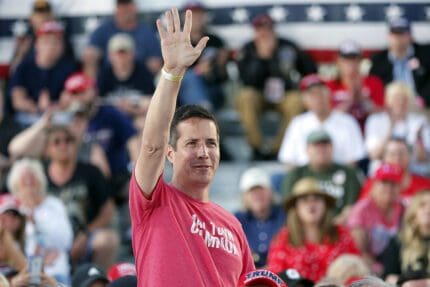

Donald Trump’s son-in-law and adviser Jared Kushner has sold his stake in a company investing in Opportunity Zone projects offering tax breaks he had pushed for in Washington, sparking criticism that he was benefiting from his White House role.

A filing at the Office of Government Ethics released Monday shows that Kushner received permission to defer capital gains taxes on the sale of his stake in Cadre, a digital platform for smaller investors in commercial properties.

Kushner’s holding in the private Cadre was worth between $25 million and $50 million, according to a financial disclosure report he filed with federal ethics officials last year.

A person familiar with the sale said Cadre asked Kushner last summer to consider selling because of worries that some potential new investors in the firm might raise conflict-of-interest issues. The person was not authorized to speak of Kushner’s personal finances and spoke only on a condition of anonymity.

Kushner and his wife, Ivanka Trump, pushed for the Opportunity Zone tax breaks to be included in Trump’s 2017 tax overhaul. The breaks offer investors big cuts in capital gains taxes if they put money into businesses and buildings in 8,700 poor, struggling neighborhoods across the country that otherwise might not attract the money.

Cadre has said it plans to invest heavily in those neighborhoods, though it is unclear just how much it has done so. Kushner also has stakes in more than a dozen properties in Opportunity Zones owned by his family firm, Kushner Cos. It is not clear if the company has taken advantage of the breaks.

Kushner stepped down as CEO of Kushner Cos. and gave up management positions at Cadre when he joined the White House three years ago.

Asked for comment, Kushner ethics lawyer Abbe Lowell referred to an earlier statement he gave to Bloomberg News saying that Kushner has complied with all ethics rules and that the sale is “the latest example of how seriously he takes this responsibility.”

Cadre declined to comment.

Kushner co-founded Cadre with his brother, Joshua, and current CEO Ryan Williams.

A Forbes magazine cover story last year said investors were shying away from the company given the links to Kushner and the Trump administration. It quoted CEO Williams saying, “I would be lying if I said the political angle wasn’t frustrating or concerning. There are people who won’t work with us, and we get that.”

Still, Kushner’s financial filings filed with federal ethics officials suggest the company isn’t doing so badly. The $25 million minimum value of Kushner’s stake at the end of last year is up sharply from three years ago when it was valued at at least $5 million.

Recommended

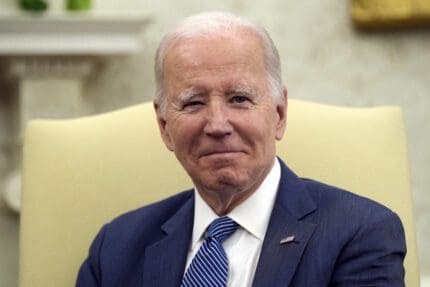

Biden campaign launches new ad focused on Affordable Care Act

Former President Trump has said he wants to do away with the popular health care law.

By Kim Lyons, Pennsylvania Capital-Star - May 08, 2024

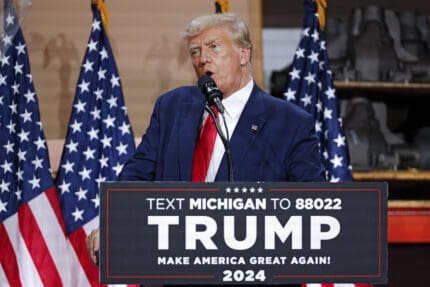

Trump leaves door open to banning medication abortion nationwide

Donald Trump is planning to release more details in the weeks ahead about how his administration would regulate access to medication abortion, according to comments he made during a lengthy interview with Time magazine published Tuesday.

By Jennifer Shutt, States Newsroom - April 30, 2024

Biden on abortion rights: President expects to give speech Tuesday on new Florida 6-week ban

‘Having the president of the United States speaking out loud and with confidence about abortion access is a great thing’

By Mitch Perry, Florida Phoenix - April 22, 2024