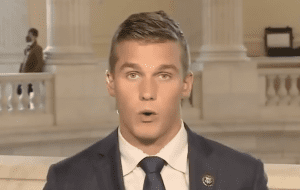

GOP congressman proposes huge corporate tax break after voting against virus aid

Madison Cawthorn voted against the relief bill meant to help millions of ordinary Americans.

A first-term Republican lawmaker is proposing a massive federal tax giveaway to companies to pay for COVID-19 safety trainings.

North Carolina Rep. Madison Cawthorn introduced a bill last week, called the “Better Businesses for Tomorrow Act,” which aims to refund half of the cost employers paid for coronavirus safety training — going back to the start of the pandemic.

“This Act will empower businesses in NC-11 to reopen safely. The government shut down our businesses, it’s only right to help them reopen,” he tweeted on Friday.

While he claimed that “The government shut down our economy,” and “The government should foot the bill to reopen our economy,” Cawthorn seems a bit confused about federalism.

The federal government did not shut down the economy at any point during the coronavirus pandemic. Donald Trump explicitly refused to issue any national stay-at-home order, leaving the matter entirely up to the states.

“We’ve talked about it … obviously there are some parts of the country that are in far deeper trouble than others,” he said in late March, explaining the lack of a national order. “If we do that, we will let you know, but it’s pretty unlikely, I think, at this time.”

“There are some states that are different. There are some states that don’t have much of a problem,” Trump argued last April. “If a state in the Midwest, or if Alaska, as an example, doesn’t have a problem, it’s awfully tough to say, ‘Close it down.’ So we have to have a little bit of flexibility.”

Instead, nearly every governor voluntarily issued statewide orders to keep their citizens safer, though a handful never closed down their economies at all.

But the Cawthorn’s bill would provide a refundable federal tax cut of up to $1,000 per employee to companies that have or had “best practices training expenses associated with protecting employees from COVID–19,” depending on the size of the business.

Seth Hanlon, a senior fellow at the Center for American Progress and an expert on tax policy, told the American Independent Foundation that while the idea has some merit, “it does seem really late in the game to enact a tax credit that stretches back to March 2020. At this point, it would probably overwhelmingly just be a windfall for employers who [did] at least some of what they were obligated to do in the first place, i.e. figure out how to keep their workers safe.”

“And if you’re going to enact a retroactive tax incentive, I’d think you’d at least want to require businesses to have actually adopted ‘best practices’ and kept their workers safe,” Hanlon added.

Cawthorn repeatedly voted against the American Rescue Plan, President Joe Biden’s $1.9 trillion package to curb the pandemic and to undo some of the economic damage it has caused.

In addition to providing billions for vaccination and testing, that law included $10 million for health and safety trainings through OSHA’s Susan Harwood Training Grant program. According to the White House, those funds are “for organizations to help keep vulnerable workers healthy and safe from COVID-19.”

The law also included some funds to help child care providers and other specific industries pay for personal protective equipment and safety trainings.

Cawthorn claims to be an advocate for a balanced budget and downsizing government, but his proposed legislation is unfunded and could massively reduce federal revenue. The Congressional Budget Office has not yet estimated its price tag.

Cawthorn’s tweet announcing the legislation said “to learn more visit cawthorn.house.gov,” his official web page. But there is no mention of the bill on that page and no press releases have been posted there in two months.

A spokesperson for the representative provided a copy of the legislative text, but did not immediately respond to questions about the bill’s cost and purpose.

Cawthorn reportedly emailed his colleagues in January to brag that he had built his staff “around comms rather than legislation.”

As of Tuesday, the bill has zero co-sponsors.

Published with permission of The American Independent Foundation.

Recommended

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023