Republicans say parents won't work if they get bigger child tax credits. They're wrong.

A new report says, ‘The benefits of the proposal far outweigh any reduction in employment.’

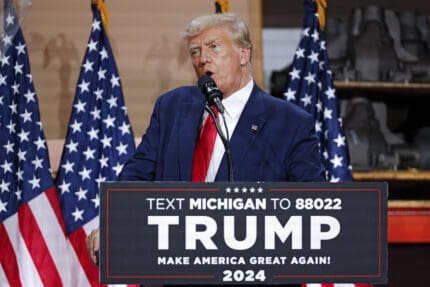

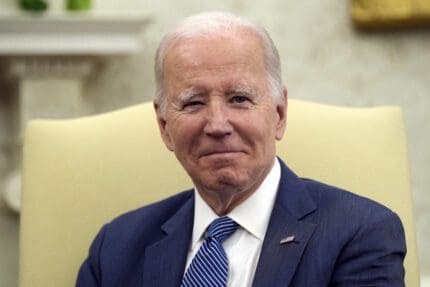

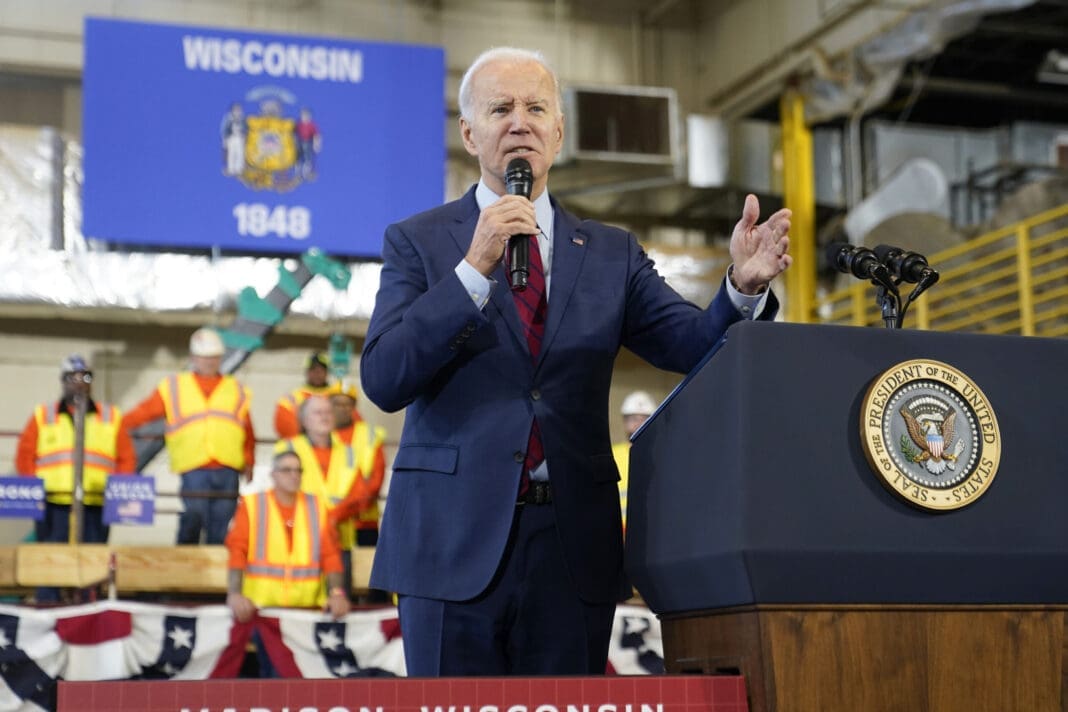

Republicans have long claimed that the expansion of the child tax credit, as proposed by President Joe Biden in his American Rescue Plan, would lead to increased unemployment by disincentivizing eligible parents from working. New research shows this is wrong.

The expansion would increase the existing $2,000 tax credit given to American parents per child per year to a refundable credit of $3,000 per child under 17 for a period of one year, or $3,600 for a child under 6. The credit would be available for individuals with incomes up to $75,000 a year and couples with incomes up to $150,000, after which point it would be phased out.

Instead of receiving the credit in one lump sum at the end of the year, qualifying families would receive monthly payments from the IRS.

A new report by the Center on Budget and Policy Priorities noted research demonstrating that such proposals have almost no effect on employment levels, and that “the benefits of the proposal far outweigh any reduction in employment.”

Researchers from the National Academies of Science, Engineering, and Medicine found that among low- and moderate-income families eligible for the tax credit, 99% would remain employed if receiving the benefit. Almost 10 million children would be lifted above or close to the poverty line, with a negligible impact on unemployment.

An analysis conducted by the Center on Poverty and Social Policy at Columbia University indicated that Biden’s proposed child tax credit expansion would reduce poverty from 13.4% to 6.6%. For Hispanic families, the poverty rate would drop from 18.9% to 11.4%, and for Black families from 20.3% to 13.3%.

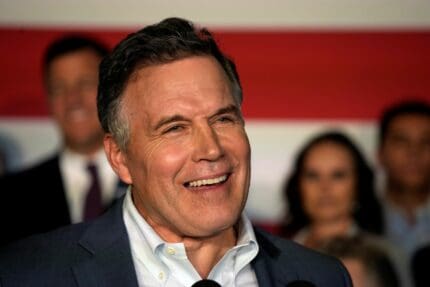

Republican Sen. Mitt Romney (UT) recently introduced his own version of the expanded child tax credit, which would give parents $350 a month per child 5 years old and under and $250 a month for children between 6 and 17. The maximum amount available through the credit would be $1,250 a month.

In Romney’s plan, individuals making less than $200,000 a year would qualify, as well as couples making less than $400,000 a year. Unlike Biden’s plan, Romney’s was presented as a permanent arrangement, not a temporary one.

But most Republicans have criticized both Biden’s and Romney’s proposals, falsely claiming that increasing the child tax credit encourages unemployment, and arguing that unless employment is a prerequisite for eligibility, parents would quit their jobs and just receive the tax credit payments instead.

Sens. Mike Lee (R-UT) and Marco Rubio (R-FL) issued a statement slamming the possibility of expanding the child tax credit without tying it to employment, calling it “welfare assistance.”

“We do not support turning the Child Tax Credit into what has been called a ‘child allowance,’ paid out as a universal basic income to all parents. That is not tax relief for working parents; it is welfare assistance,” they wrote. “An essential part of being pro-family is being pro-work. Congress should expand the Child Tax Credit without undercutting the responsibility of parents to work to provide for their families.”

Rubio also wrote in a February op-ed, “If pulling families out of poverty were as simple as handing moms and dads a check, we would have solved poverty a long time ago.”

Right-wing economists have also expressed opposition to expanding the child tax credit on the basis of it supposedly encouraging unemployment.

Economist Veronique de Rugy, who hails from George Mason University’s Mercatus Center, told the New York Times, “At the very least, policies shouldn’t create disincentives to work, produce long-term economic consequences, nor enable dependency on the benefit.”

She added that offering monthly payments to parents without requiring employment as a qualifier would be “transporting us to a pre-1996-welfare-reform world where the benefit is available no matter the marital or employment status of the parents.”

But others have argued that such measures to reduce child poverty should not be dependent on parental employment.

Treasury Secretary Janet Yellen said in February, “We have 24 million adults and 12 million children that are going hungry every day. … We have people suffering, particularly low-wage workers and minorities, and through absolutely no fault of their own. We have to get them to the other side and make sure this doesn’t take a permanent toll on their lives.”

The Institute on Taxation and Economic Policy’s federal tax policy director, Steve Wamhoff, also condemned GOP attempts to tie the benefit to employment.

“Is the goal to reduce child poverty or not?” he said. “And if that is the goal, then you give assistance to families with children. It’s pretty straight forward.”

Published with permission of The American Independent Foundation.

Recommended

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

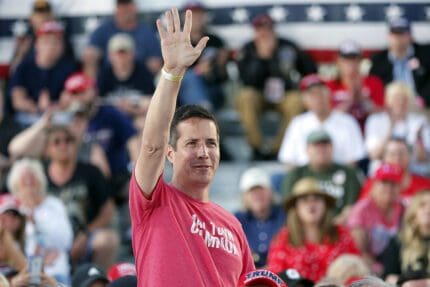

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023