Democrats' proposal could raise trillions by taxing the richest 0.05%

The Ultra-Millionaire Tax Act would only impact those worth more than $50 million.

Three congressional Democrats unveiled a plan Monday to raise $3 trillion in new revenue over the next decade. By taxing only those worth more than $50 million, the proposal would not raise taxes on 99.95% of Americans.

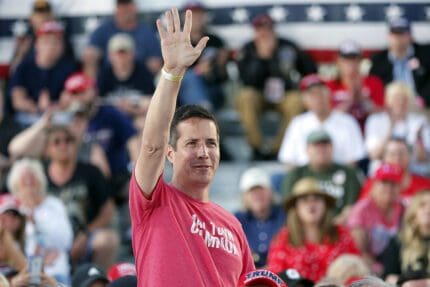

Sen. Elizabeth Warren of Massachusetts, Rep. Pramila Jayapal of Washington, and Rep. Brendan Boyle of Pennsylvania introduced the Ultra-Millionaire Tax Act of 2021, which would establish a 2% annual tax on the net worth of those taxable assets of $50 million to $1 billion. Those worth more than $1 billion would pay a 3% annual tax.

“The hyper concentration of wealth among a tiny number of multimillionaires and billionaires is a crisis for American capitalism and the American Dream,” Boyle said in a press release. “Wealth inequality is at its highest level since the Gilded Age. The wealth share of the richest 0.1% has nearly tripled since the late 1970s. It is time for the ultra-millionaires to pay their fair share so that critical government programs can be bolstered to help the everyday American.”

The sponsors circulated an analysis by University of California, Berkeley, economics professors Emmanuel Saez and Gabriel Zucman that predicted the wealth tax would affect only 100,000 families and would raise $3 trillion in new federal revenue between 2023 and 2032.

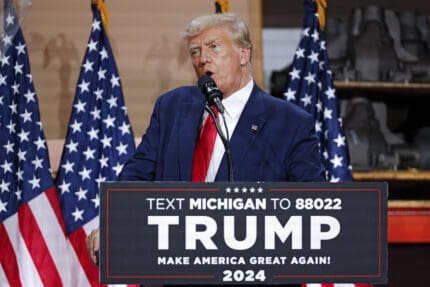

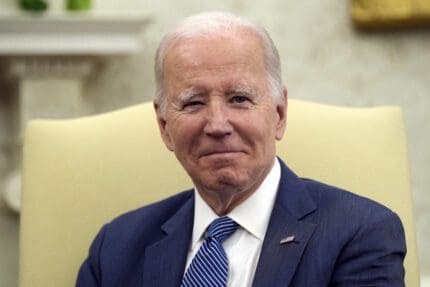

The proposal comes as Republicans in Congress are making a big deal about the growing national debt they helped rack up and using the budget deficit as an excuse to oppose President Joe Biden’s priorities, such as COVID-19 relief.

“For too long, Congress has maxed out America’s credit card with no plan to pay off our debts. The disastrous impacts of this reckless spending and growing debt, like high inflation, will hurt low and fixed income families the most. We must do better,” tweeted Florida Sen. Rick Scott on Feb. 16.

“Eventually USA $28 Trillion debt bill becomes due,” warned Rep. Mo Brooks of Alabama on Thursday. “Friday #Socialist #Democrat debt junkies to borrow & spend ANOTHER $2 Trillion.”

This wealth tax could either offset some of those previous expenses or enable new spending without increasing the debt.

According to the Saez-Zucman analysis, the richest Americans would be asked to pay about 4.3% of their wealth each year on average, compared to an estimated 3.2% in 2019.

A Data for Progress poll, taken in 11 states between July and September 2020, found widespread public support for the idea of a 2% wealth tax on those with a $50 million-plus net worth.

Among all voters surveyed, 62% preferred adopting the idea, compared to 26% who preferred the current system. Even in the deep-red state of Mississippi, voters preferred the wealth tax 55% to 30%.

The proposal comes as Republicans are trying to change their image as the party looking out for the very rich.

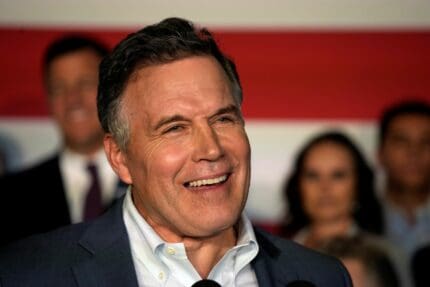

“The uniqueness of this party today is we’re the workers’ party, we’re the American workers’ party,” claimed House Minority Leader Kevin McCarthy in a Feb. 8 Punchbowl News interview.

Sen. Ted Cruz of Texas tweeted Friday, “The Republican Party is not just the party of country clubs, the Republican Party is the party of steel workers, construction workers, pipeline workers, police officers, firefighters, waiters and waitresses.” He also tweeted Friday, “The Republican Party is not the party of the country clubs, it’s the party of hardworking, blue-collar men and women.”

Still, not a single Republican lawmaker has co-sponsored the Ultra-Millionaire Tax Act so far.

In addition to the three lead sponsors, it is co-sponsored by Sens. Bernie Sanders (I-VT), Sheldon Whitehouse (D-RI), Jeff Merkley (D-OR), Kirsten Gillibrand (D-NY), Brian Schatz (D-HI), Ed Markey (D-MA), and Mazie Hirono (D-HI).

Published with permission of The American Independent Foundation.

Recommended

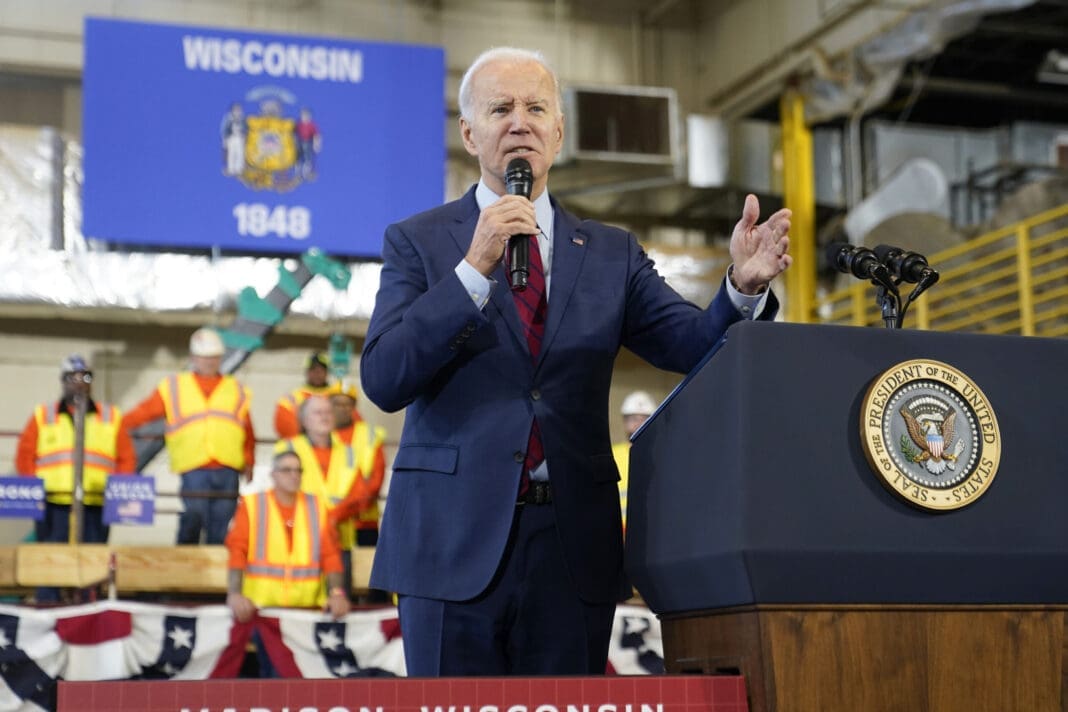

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023