GOP complains that Biden wants corporations to pay their fair share of taxes

Their claims are full of lies and misleading half-truths about who would be impacted and how President Joe Biden’s proposal works.

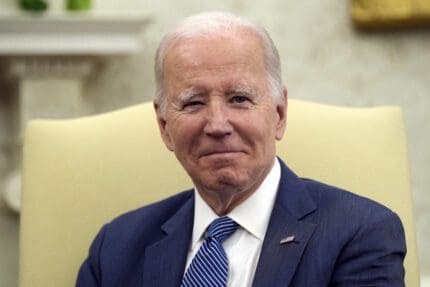

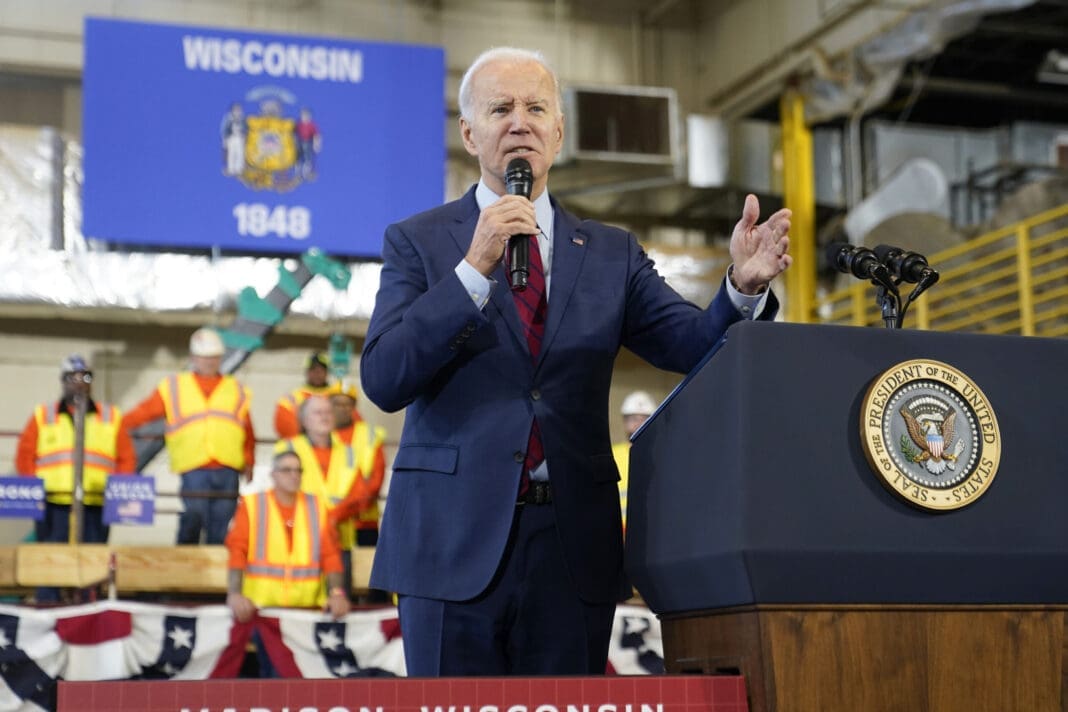

Republicans in Congress are criticizing President Joe Biden’s proposed tax increases to fund his newly unveiled jobs and infrastructure plan — and, in the process, are spreading widely debunked disinformation about who is impacted by the increases and what they would actually do.

Biden’s $2 trillion infrastructure plan, the American Jobs Plan, allots $621 billion for transportation infrastructure and $650 billion for domestic infrastructure. The plan would also provide $400 billion toward the “caretaking economy” of elderly and disabled Americans, as well as $580 billion for research and development, including within the manufacturing industry.

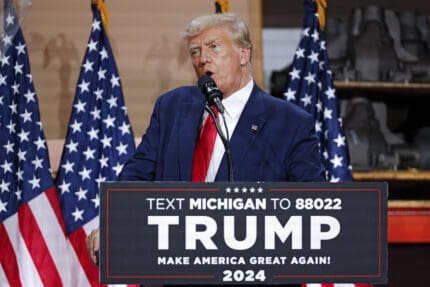

While the plan would be funded by tax increases, Biden’s proposal would not raise taxes on the middle class or those in lower income brackets. It would only raise taxes on Americans making more than $400,000 a year, and would raise the corporate tax rate from 25% to 28% by repealing parts of Donald Trump’s 2017 Tax Cuts and Jobs Act.

And recent polling shows Americans support raising taxes on the rich and corporations to fund the infrastructure plan.

But the facts aren’t stopping Republicans from voicing opposition and making false claims about what Biden intends to do.

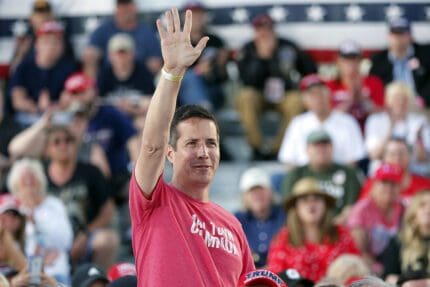

Sen. John Kennedy (R-LA) and others have insisted Biden’s tax hikes would kill American jobs and harm the nation’s economic recovery.

“Pres. Biden is planning to raise taxes dramatically,” Kennedy tweeted on March 29. “This will have a profoundly bad impact on the economy. When you tax something, you get less of it — not more. Less prosperity, fewer jobs.”

But this argument relies on the questionable premise that higher taxes mean job losses and decreased wages, and that lower taxes mean increased jobs and increased wages. But in fact, numerous studies show that job growth often doesn’t accompany lower taxes for corporations and the wealthy. And there’s certainly no strong evidence to support claims that lower taxes raise workers’ incomes.

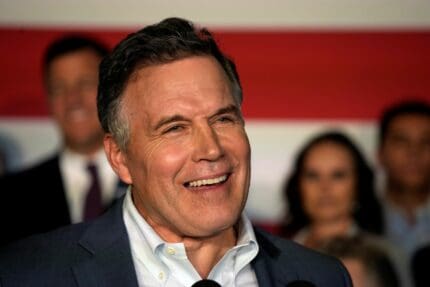

Rep. Bill Huizenda (R-MI) made another misleading claim on April 1. “Why does President Biden’s proposal raise taxes to a level higher than Communist China’s?” he tweeted.

While it’s true that China’s corporate tax rate currently sits at 25%, that figure marks an all-time low. In fact, the country’s average tax rate from 1997 to 2021 sat at 28.52%, peaking in 1998 at 33%.

Sen. Marsha Blackburn (R-TN), meanwhile, claimed that Biden’s tax hikes would send manufacturing jobs overseas.

“With a corporate tax rate of 28%, Biden will drag the U.S. back to a time when businesses sent jobs overseas to countries with friendlier rates,” she tweeted. “American jobs should stay here.”

But Biden’s infrastructure plan, which a corporate tax increase would fund, is poised to bring back the many manufacturing jobs that Trump’s claimed he’d restore — and didn’t. Moreover, manufacturing industry jobs actually fell by 240,000 under Trump due to his mismanagement of the pandemic.

Republicans also falsely claim Biden wants to raise taxes on lower and middle income earners and small businesses.

Last week, in a House Financial Services Committee meeting, Rep. Ann Wagner (MO) interrogated Treasury Secretary Janet Yellen, asking, “Why, as this country begins to reopen and recover economically, would the Biden administration be proposing tax policy which would in the end hurt the American family and millions of struggling small businesses?”

But there’s no evidence that Biden’s proposed tax hike would affect the 98.2% percent of American families making less than $400,000 a year.

Additionally, contrary to Wagner’s claims, most small businesses would be unaffected by an increased corporate tax. As The Balance noted in February, “About 75% of small businesses are not corporations. This large percentage of small businesses are considered ‘pass-through’ entities, which means they pay tax at the personal tax rate of the owner.”

Other Republican arguments have been equally misleading.

In March, Rep. Kevin Brady (R-TX), the House Ways and Means Committee’s highest-ranking Republican, falsely claimed, “No president has ever raised business taxes to recover from an economic crisis. This couldn’t come at a worse time.”

But the late former President Herbert Hoover, a Republican, signed into law the Revenue Act of 1932 in the midst of the country’s worst economic recession, the Great Depression. This legislation notably raised the corporate tax to nearly 14% from where it sat at 11% when the stock market first crashed in 1929, and upped taxes on top income earners from 25% to 63%.

And in the aftermath of the financial panic of 1907, which set off the worst U.S. economic recession until the Great Depression, the late former Republican president William Howard Taft lobbied to pass the 16th Amendment — the amendment which introduced the corporate tax in the first place.

Published with permission of The American Independent Foundation.

Recommended

Biden calls for expanded child tax credit, taxes on wealthy in $7.2 trillion budget plan

President Joe Biden released his budget request for the upcoming fiscal year Monday, calling on Congress to stick to the spending agreement brokered last year and to revamp tax laws so that the “wealthy pay their fair share.”

By Jennifer Shutt, States Newsroom - March 11, 2024

December jobs report: Wages up, hiring steady as job market ends year strong

Friday’s jobs data showed a strong, resilient U.S. labor market with wages outpacing inflation — welcome news for Americans hoping to have more purchasing power in 2024.

By Casey Quinlan - January 05, 2024

Biden’s infrastructure law is boosting Nevada’s economy. Sam Brown opposed it.

The Nevada Republican U.S. Senate hopeful also spoke out against a rail project projected to create thousands of union jobs

By Jesse Valentine - November 15, 2023