Rex Tillerson's stocks shot up $9 million after he was tapped as Trump secretary of state

President-elect Donald Trump’s pick to lead the State Department already faces stiff opposition over his relationship with Russia, including a $500 billion deal with Russian government-owned Rosneft. Beyond that, though, ExxonMobil CEO Rex Tillerson also faces conflicts surrounding his stock holdings and pension plan that look to be nearly impossible to untangle. Tillerson currently holds 2,618,856 shares […]

President-elect Donald Trump’s pick to lead the State Department already faces stiff opposition over his relationship with Russia, including a $500 billion deal with Russian government-owned Rosneft. Beyond that, though, ExxonMobil CEO Rex Tillerson also faces conflicts surrounding his stock holdings and pension plan that look to be nearly impossible to untangle.

Tillerson currently holds 2,618,856 shares of ExxonMobil stock, a portfolio worth $233,078,184.00 as of the Friday before Tillerson’s selection was reported. By closing time the following Monday, they had shot up more than $5 million to $238,289,707.44, and gained another $4.1 million by the end of the day when his selection was officially announced.

In addition to the stocks, Tillerson has an ExxonMobil pension worth nearly $70 million.

According to Forbes, Tillerson faces three choices where his stocks are concerned, two of which would result in him losing between $71 million and $190 million of his fortune. Then there is this issue:

Tillerson holds just over 2.6 million Exxon shares. But he actually only technically owns 611,087 outright, or nearly $57 million worth. The rest are so-called restricted stock units. He holds the shares, and even collects the dividends they pay out, but he doesn’t technically own the shares, and it would be a while until he can.

Just over 1.3 million of those shares don’t vest—meaning fully become Tillerson’s property—until 2025. That’s a problem logistically, but also for the divestiture rules. The tax loophole that allows individuals taking government jobs to defer capital gains taxes only applies to stock that you fully own. RSU, on the other hand, are taxed as income when they vest, which Tillerson can’t avoid paying even if he rolls the shares into a mutual fund.

As Forbes notes, if Tillerson sells only the shares he actually owns, he will head the State Department while knowing that a hundred million dollars or so of ExxonMobil stock await him down the road — a consideration that could potentially influence an unimaginable number of State Department decisions and policies, as energy resources figure prominently in U.S. foreign policy.

Tillerson’s Russian ties and financial entanglements may make him a good fit for Donald Trump, but not for the American people.

Recommended

Republican Jay Ashcroft backs anti-abortion clinics that push lies and disinformation

The Republic Pregnancy Resource Center website provides step-by-step directions from local middle and high schools to their address.

By Jesse Valentine - May 14, 2024

More than half of Republican Jay Ashcroft’s funding comes from outside Missouri

Ashcroft has criticized other campaigns for relying on out-of-state donors

By Jesse Valentine - April 25, 2024

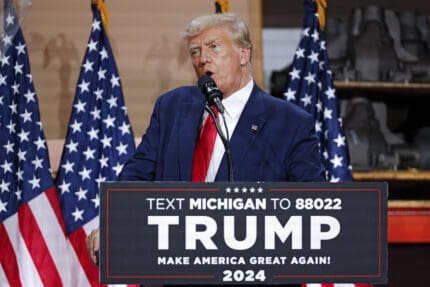

Battleground GOP candidates rally around Trump’s tax cuts for the rich

Even Larry Hogan, a Trump critic, supports the former president’s tax policy.

By Jesse Valentine - April 12, 2024