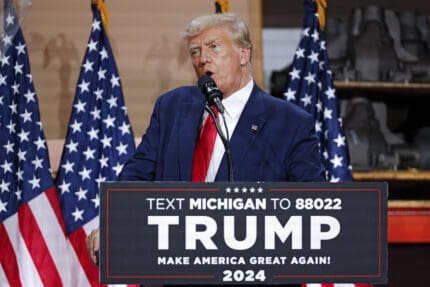

Trump's tax plan hits single working parents particularly hard

With all the chaos surrounding the transition to a Trump administration, it is easy to lose sight of even major policy developments. Rutgers University Professor Brittney Cooper flagged a particularly significant issue that has received little attention: https://twitter.com/ProfessorCrunk/status/798532053692272644 Eliminating the head-of-household filing status is a major change, with potentially severe consequences for some who currently use […]

With all the chaos surrounding the transition to a Trump administration, it is easy to lose sight of even major policy developments. Rutgers University Professor Brittney Cooper flagged a particularly significant issue that has received little attention:

https://twitter.com/ProfessorCrunk/status/798532053692272644

Eliminating the head-of-household filing status is a major change, with potentially severe consequences for some who currently use it. Roberton Williams at Forbes lays out what it means:

First, he would eliminate the head-of-household filing status, thus requiring single parents to file as individuals. By itself, that boosts tax rates for single parents at most income ranges.

Second, although Trump would boost the standard deduction, he would eliminate personal and dependent exemptions, raising taxable income for all single parents who do not itemize. Under current law in 2017, a single parent with one child can take a $9,400 standard deduction and two $4,100 exemptions, thus reducing her taxable income by $17,600. Trump would replace that combination with a $15,150 standard deduction, making $2,450 more income subject to tax. And bigger families would get hit even harder—their taxable income under Trump’s plan would go up by $4,100 for each additional child, relative to current law.

Finally—and most consequentially—Trump would collapse the current tax schedule from seven rates to three. That may seem less complicated but it would actually raise rates at some income levels. The result: Higher taxes for many heads of household.

The article goes on to explain that a single parent would be no worse off if they made $15,150 or less, and would not see any benefit unless their income reached $560,000 a year. But: “Trump’s tax rates would increase a single parent’s tax bill at almost every AGI level between $15,150 and about $560,000.”

Single working parents are apparently one more set of people who are not of much concern in Trump’s America.

Recommended

Republican Jay Ashcroft backs anti-abortion clinics that push lies and disinformation

The Republic Pregnancy Resource Center website provides step-by-step directions from local middle and high schools to their address.

By Jesse Valentine - May 14, 2024

More than half of Republican Jay Ashcroft’s funding comes from outside Missouri

Ashcroft has criticized other campaigns for relying on out-of-state donors

By Jesse Valentine - April 25, 2024

Battleground GOP candidates rally around Trump’s tax cuts for the rich

Even Larry Hogan, a Trump critic, supports the former president’s tax policy.

By Jesse Valentine - April 12, 2024